SEE: http://borgenproject.org/inequality-equal-share-world/ & https://en.wikipedia.org/wiki/Robert_ReichHow to Shrink Inequality

MONDAY, MAY 12, 2014 Robert Reich. (Pres Clinton's cabinet member Sec of LABOR)

Some inequality of income and wealth is inevitable, if not necessary. If an economy is to function well, people need incentives to work hard (This guy doesn't like WELFARE) and innovate.( Oh, you mean motivators...like no shoes, coats, heat, light, vehicles, homelessness, starvation, no way to show up at campus much less get a grant or loan. Or show up at STARBUCKS for a job. College deg. req'd for THAT.)

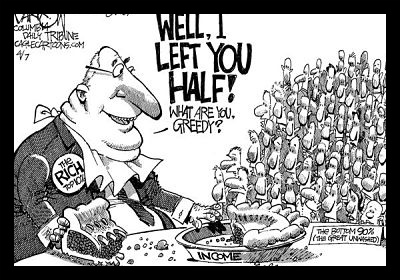

The pertinent question is not whether income and wealth inequality is good or bad. It is at what point do these inequalities become so great as to pose a serious threat to our economy, our ideal of equal opportunity and our democracy. (I think they've ARRIVED at that point, Bob. That bus has left)

We are near or have already reached that tipping point. As French economist Thomas Piketty shows beyond doubt in his “Capital in the Twenty-First Century,” we are heading back to levels of inequality not seen since the Gilded Age of the late 19th century. The dysfunctions of our economy and politics are not self-correcting when it comes to inequality.

But a return to the Gilded Age is not inevitable. It is incumbent on us to dedicate ourselves to reversing this diabolical trend. But in order to reform the system, we need a political movement for shared prosperity.

Herewith a short summary of what has happened, how it threatens the foundations of our society, why it has happened, and what we must do to reverse it.

What has Happened

The data on widening inequality are remarkably and disturbingly clear. The Congressional Budget Office has found that between 1979 and 2007, the onset of the Great Recession, the gap in income—after federal taxes and transfer payments—more than tripled between the top 1 percent of the population and everyone else. The after-tax, after-transfer income of the top 1 percent increased by 275 percent, while it increased less than 40 percent for the middle three quintiles of the population and only 18 percent for the bottom quintile. (Google the term SECUESTRATION OF WEALTH, read those articles. THINK. HOW WOULD ANY OF US EVER GET THAT MONEY OUT OF DUSTY VAULTS?. A few beauties who can marry it. Yes. THE IRS which can re-distribute it for upward mobility of bright children, as scholarships. Chicks and Taxes. That's about it.)

The gap has continued to widen in the recovery. (This post 2008 Recovery hasn't hit HERE, Bob.) According to the Census Bureau, median family and median household incomes have been falling, adjusted for inflation; while according to the data gathered by my colleague Emmanuel Saez, the income of the wealthiest 1 percent has soared by 31 percent. In fact, Saez has calculated that 95 percent of all economic gains since the recovery began have gone to the top 1 percent.

Wealth has become even more concentrated than income. An April 2013 Pew Research Center report found that from 2009 to 2011, “the mean net worth of households in the upper 7 percent of wealth distribution rose by an estimated 28 percent, while the mean net worth of households in the lower 93 percent dropped by 4 percent.”

This is a RECOVERY?

Why THIS GIGANTIC INEQUALITY Threatens Our Society

This trend is now threatening the three foundation stones of our society: our economy, our ideal of equal opportunity and our democracy.

The economy. In the United States, consumer spending accounts for approximately 70 percent of economic activity. If consumers don’t have adequate purchasing power, businesses have no incentive to expand or hire additional workers. Because the rich spend a smaller proportion of their incomes than the middle class and the poor, it stands to reason that as a larger and larger share of the nation’s total income goes to the top, consumer demand is dampened. If the middle class is forced to borrow in order to maintain its standard of living, that dampening may come suddenly—when debt bubbles burst.

Consider that the two peak years of inequality over the past century—when the top 1 percent garnered more than 23 percent of total income—were 1928 and 2007. Each of these periods was preceded by substantial increases in borrowing, which ended notoriously in the Great Crash of 1929 and the near-meltdown of 2008.

The anemic recovery we are now experiencing is directly related to the decline in median household incomes after 2009, coupled with the inability or unwillingness of consumers to take on additional debt and of banks to finance that debt—wisely, given the damage wrought by the bursting debt bubble. We cannot have a growing economy without a growing and buoyant middle class. We cannot have a growing middle class if almost all of the economic gains go to the top 1 percent.

Equal opportunity. Widening inequality also challenges the nation’s core ideal of equal opportunity, because it hampers upward mobility. High inequality correlates with low upward mobility. Studies are not conclusive because the speed of upward mobility is difficult to measure.

But even under the unrealistic assumption that its velocity is no different today than it was thirty years ago—that someone born into a poor or lower-middle-class family today can move upward at the same rate as three decades ago—widening inequality still hampers upward mobility. That’s simply because the ladder is far longer now. The distance between its bottom and top rungs, and between every rung along the way, is far greater. Anyone ascending it at the same speed as before will necessarily make less progress upward.

In addition, when the middle class is in decline and median household incomes are dropping, there are fewer possibilities for upward mobility. A stressed middle class is also less willing to share the ladder of opportunity with those below it. For this reason, the issue of widening inequality cannot be separated from the problems of poverty and diminishing opportunities for those near the bottom. They are one and the same.

Democracy. The connection between widening inequality and the undermining of democracy has long been understood. As former Supreme Court Justice Louis Brandeis is famously alleged to have said in the early years of the last century, an era when robber barons dumped sacks of money on legislators’ desks, “We may have a democracy, or we may have great wealth concentrated in the hands of a few, but we cannot have both.”

As income and wealth flow upward, political power follows. Money flowing to political campaigns, lobbyists, think tanks, “expert” witnesses and media campaigns buys disproportionate influence. With all that money, no legislative bulwark can be high enough or strong enough to protect the democratic process.

The threat to our democracy also comes from the polarization that accompanies high levels of inequality. Partisanship—measured by some political scientists as the distance between median Republican and Democratic roll-call votes on key economic issues—almost directly tracks with the level of inequality. It reached high levels in the first decades of the twentieth century when inequality soared, and has reached similar levels in recent years.

When large numbers of Americans are working harder than ever but getting nowhere, and see most of the economic gains going to a small group at the top, they suspect the game is rigged. Some of these people can be persuaded that the culprit is big government; others, that the blame falls on the wealthy and big corporations. The result is fierce partisanship, fueled by anti-establishment populism on both the right and the left of the political spectrum.

Why It Has Happened

Between the end of World War II and the early 1970s, the median wage grew in tandem with productivity. Both roughly doubled in those years, adjusted for inflation. But after the 1970s, productivity continued to rise at roughly the same pace as before, while wages began to flatten. In part, this was due to the twin forces of globalization and labor-replacing technologies that began to hit the American workforce like strong winds—accelerating into massive storms in the 1980s and ’90s, and hurricanes since then.

Containers, satellite communication technologies, and cargo ships and planes radically reduced the cost of producing goods anywhere around the globe, thereby eliminating many manufacturing jobs or putting downward pressure on other wages. Automation, followed by computers, software, robotics, computer-controlled machine tools and widespread digitization, further eroded jobs and wages. These forces simultaneously undermined organized labor. Unionized companies faced increasing competitive pressures to outsource, automate or move to nonunion states.

These forces didn’t erode all incomes, however. In fact, they added to the value of complex work done by those who were well educated, well connected and fortunate enough to have chosen the right professions. Those lucky few who were perceived to be the most valuable saw their pay skyrocket.

But that’s only part of the story. Instead of responding to these gale-force winds with policies designed to upgrade the skills of Americans, modernize our infrastructure, strengthen our safety net and adapt the workforce—and pay for much of this with higher taxes on the wealthy—we did the reverse. We began disinvesting in education, job training and infrastructure. We began shredding our safety net. We made it harder for many Americans to join unions. (The decline in unionization directly correlates with the decline of the portion of income going to the middle class.) And we reduced taxes on the wealthy.

We also deregulated. Financial deregulation in particular made finance the most lucrative industry in America, as it had been in the 1920s. Here again, the parallels between the 1920s and recent years are striking, reflecting the same pattern of inequality.

Other advanced economies have faced the same gale-force winds but have not suffered the same inequalities as we have because they have helped their workforces adapt to the new economic realities—leaving the United States the most unequal of all advanced nations by far.

What We Must Do

There is no single solution for reversing widening inequality. Thomas Piketty’s monumental book “Capital in the Twenty-First Century” paints a troubling picture of societies dominated by a comparative few, whose cumulative wealth and unearned income overshadow the majority who rely on jobs and earned income. But our future is not set in stone, and Piketty’s description of past and current trends need not determine our path in the future. Here are ten initiatives that could reverse the trends described above:

1) Make work pay. The fastest-growing categories of work are retail, restaurant (including fast food), hospital (especially orderlies and staff), hotel, childcare and eldercare. But these jobs tend to pay very little. A first step toward making work pay is to raise the federal minimum wage to $15 an hour, pegging it to inflation; abolish the tipped minimum wage; and expand the Earned Income Tax Credit. No American who works full time should be in poverty.

2) Unionize low-wage workers. The rise and fall of the American middle class correlates almost exactly with the rise and fall of private-sector unions, because unions gave the middle class the bargaining power it needed to secure a fair share of the gains from economic growth. We need to reinvigorate unions, beginning with low-wage service occupations that are sheltered from global competition and from labor-replacing technologies. Lower-wage Americans deserve more bargaining power.

3) Invest in education. This investment should extend from early childhood through world-class primary and secondary schools, affordable public higher education, good technical education and lifelong learning. Education should not be thought of as a private investment; it is a public good that helps both individuals and the economy. Yet for too many Americans, high-quality education is unaffordable and unattainable. Every American should have an equal opportunity to make the most of herself or himself. High-quality education should be freely available to all, starting at the age of 3 and extending through four years of university or technical education.

4) Invest in infrastructure. Many working Americans—especially those on the lower rungs of the income ladder—are hobbled by an obsolete infrastructure that generates long commutes to work, excessively high home and rental prices, inadequate Internet access, insufficient power and water sources, and unnecessary environmental degradation. Every American should have access to an infrastructure suitable to the richest nation in the world.

5) Pay for these investments with higher taxes on the wealthy. Between the end of World War II and 1981 (when the wealthiest were getting paid a far lower share of total national income), the highest marginal federal income tax rate never fell below 70 percent, and the effective rate (including tax deductions and credits) hovered around 50 percent. But with Ronald Reagan’s tax cut of 1981, followed by George W. Bush’s tax cuts of 2001 and 2003, the taxes on top incomes were slashed, and tax loopholes favoring the wealthy were widened. The implicit promise—sometimes made explicit—was that the benefits from such cuts would trickle down to the broad middle class and even to the poor. As I’ve shown, however, nothing trickled down. At a time in American history when the after-tax incomes of the wealthy continue to soar, while median household incomes are falling, and when we must invest far more in education and infrastructure, it seems appropriate to raise the top marginal tax rate and close tax loopholes that disproportionately favor the wealthy.

6) Make the payroll tax progressive. Payroll taxes account for 40 percent of government revenues, yet they are not nearly as progressive as income taxes. One way to make the payroll tax more progressive would be to exempt the first $15,000 of wages and make up the difference by removing the cap on the portion of income subject to Social Security payroll taxes.

7) Raise the estate tax and eliminate the “stepped-up basis” for determining capital gains at death. As Piketty warns, the United States, like other rich nations, could be moving toward an oligarchy of inherited wealth and away from a meritocracy based on labor income. The most direct way to reduce the dominance of inherited wealth is to raise the estate tax by triggering it at $1 million of wealth per person rather than its current $5.34 million (and thereafter peg those levels to inflation). We should also eliminate the “stepped-up basis” rule that lets heirs avoid capital gains taxes on the appreciation of assets that occurred before the death of their benefactors.

8) Constrain Wall Street. The financial sector has added to the burdens of the middle class and the poor through excesses that were the proximate cause of an economic crisis in 2008, similar to the crisis of 1929. Even though capital requirements have been tightened and oversight strengthened, the biggest banks are still too big to fail, jail or curtail—and therefore capable of generating another crisis. The Glass-Steagall Act, which separated commercial- and investment-banking functions, should be resurrected in full, and the size of the nation’s biggest banks should be capped.

9) Give all Americans a share in future economic gains. The richest 10 percent of Americans own roughly 80 percent of the value of the nation’s capital stock; the richest 1 percent own about 35 percent. As the returns to capital continue to outpace the returns to labor, this allocation of ownership further aggravates inequality. Ownership should be broadened through a plan that would give every newborn American an “opportunity share” worth, say, $5,000 in a diversified index of stocks and bonds—which, compounded over time, would be worth considerably more. The share could be cashed in gradually starting at the age of 18.

10) Get big money out of politics. Last, but certainly not least, we must limit the political influence of the great accumulations of wealth that are threatening our democracy and drowning out the voices of average Americans. The Supreme Court’s 2010 Citizens United decision must be reversed—either by the Court itself, or by constitutional amendment. In the meantime, we must move toward the public financing of elections—for example, with the federal government giving presidential candidates, as well as House and Senate candidates in general elections, $2 for every $1 raised from small donors.

Building a Movement

It’s doubtful that these and other measures designed to reverse widening inequality will be enacted anytime soon. Having served in Washington, I know how difficult it is to get anything done unless the broad public understands what’s at stake and actively pushes for reform.

That’s why we need a movement for shared prosperity—a movement on a scale similar to the Progressive movement at the turn of the last century, which fueled the first progressive income tax and antitrust laws; the suffrage movement, which won women the vote; the labor movement, which helped animate the New Deal and fueled the great prosperity of the first three decades after World War II; the civil rights movement, which achieved the landmark Civil Rights and Voting Rights acts; and the environmental movement, which spawned the National Environmental Policy Act and other critical legislation.

Time and again, when the situation demands it, America has saved capitalism from its own excesses. We put ideology aside and do what’s necessary. No other nation is as fundamentally pragmatic. We will reverse the trend toward widening inequality eventually. We have no choice. But we must organize and mobilize in order that it be done.

[This essay appears in the current edition of “The Nation.”]

Share

364 NOTES FROM OTHER TUMBLR USERS

BACK TO THE TOPPREVIOUS NEXT POST

Discuss on Facebook

Click for Town Square Videos

THE REALITY OF FREE TRADE DEALS

Free trade is figuring prominently in the upcoming presidential election. Donald Trump is against it. Hillary Clinton has expressed qualms.

Economists still think free trade benefits most Americans, but according to polls, only 35% of voters agree.

Why this discrepancy?

Because economists support any policy that improves efficiency and they typically define a policy as efficient if the people who benefit from it could compensate those who lose from it and still come out ahead.

But this way of looking at things leaves out 3 big realities.

1. Inequality keeps growing. In a society of widening inequality, the winners are often wealthier than the losers, so even if they fully compensate the losers, as the winners gain more ground, the losers may feel even worse off.

2. Safety nets keep unraveling. As a practical matter, the winners don’t compensate the losers. Most of the losers from trade, the millions whose good jobs have been lost, don’t even have access to unemployment insurance. Trade adjustment assistance is a joke. America invests less in jobs training as a percent of our economy than almost any other advanced nation.

3. Median pay keeps dropping. Those whose paychecks have been declining because of trade don’t make up for those declines by having access to cheaper goods and services from abroad. Yes, those cheaper goods help but adjusted for inflation, the median hourly pay of production workers is still lower today than it was in 1974.

So if we want the public to support free trade, we’ve got to ensure that everyone benefits from it.

This means we need a genuine reemployment system – including not only unemployment insurance, but also income insurance. So if you lose your job and have to take one that pays less, you get a portion of the difference for up to a year.

More basically, we’ve got to ensure that the gains from trade are more widely shared.

Why a Tax on Wall Street Trades is an Even Better Idea Than You Know

One of Bernie Sanders’s most important proposals didn’t receive enough attention and should become a law even without a president Sanders. Hillary Clinton should adopt it for her campaign.

It’s a tax on financial transactions.

Putting a small tax on financial transactions would:

1. reduce incentives for high speed trading, insider deal making and short term financial betting. Buying and selling stocks and bonds in order to beat others who are buying stocks and bonds is a giant zero sum game. It wastes countless resources, uses up the talents of some of the nation’s best and brightest and subjects financial markets to unnecessary risk.

2. generate lots of revenue. Even a one tenth of 1% transaction tax would raise $185 billion over 10 years according to the non-partisan Tax Policy Center. It could thereby finance public investments that enlarge the economic pie rather than merely rearranging its slices. Investments like better schools and access to college.

3. it’s fair. After all, Americans pay sales taxes on all sorts of goods and services, yet Wall Street traders pay no sales tax on the stocks and bonds they buy, which helps explain why the financial industry generates about 30% of America’s corporate profits, but pays only about 18% of corporate taxes.

Wall Street’s objections are baloney.

Wall Street says even a small transaction tax on financial transactions would drive trading overseas since financial trades can easily be done elsewhere.

Baloney. The U.K. has had a tax on stock trades for decades, yet remains one of the world’s financial powerhouses. Incidentally, that tax raises about 3 billion pounds yearly. That’s the equivalent of 30 billion in an economy the size of the United States, which is a big help for Britain’s budget. At least 28 other countries also have such a tax and the European Union is well on the way to implementing one.

Wall Street also claims that the tax would burden small investors such as as retirees, business owners and average savers.

Wrong again. The tax wouldn’t be a burden if it reduces the volume and frequency of trading, which is the whole point. In fact, the tax is highly progressive. The Tax Policy Center estimates that 75% of it would be paid by the richest 5th of taxpayers and 40% by the top 1%.

So, why aren’t politicians of all stripes supporting it? Because the financial transactions tax directly threatens a major source of Wall Street’s revenue. And if you hadn’t noticed, the Street uses a portion of its vast revenues to gain political clout. Which may be one of the best reasons for enacting it.

BERNIE’S 7 LEGACIES

Bernie Sanders’s campaign is now officially over, but the movement he began is still just beginning. He’s provided it seven big legacies:

First, Bernie has helped open America’s eyes to the power of big money corrupting our democracy and thereby rigging our economy to its advantage and everyone else’s disadvantage.

Polls now show huge majorities of Americans think moneyed interests have too much sway in Washington. And thanks, in large part, to Bernie’s campaign, progressives on Capitol Hill are readying a constitutional amendment to overturn Citizens United, and bills requiring full disclosure of donors, ending gerrymandering, and providing automatic voter registration.

None of these will get anywhere in a Republican-controlled Congress, but they will give progressives a powerful theme for the upcoming election. It’s called democracy.

Second, Bernie has shown that it’s possible to win elections without depending on big money from corporations, Wall Street, and billionaires. He came close to winning the Democratic nomination on the basis of millions of small donations from average working people. No longer can a candidate pretend to believe in campaign finance reform but say they have to take big money because their opponent does.

Third, Bernie has educated millions of Americans about why we must have a single-payer health-care system and free tuition at public universities, and why we must resurrect the Glass-Steagall Act and bust up the biggest banks. These issues will be front and center in every progressive campaign from here out, at all levels of American politics.

Fourth,the Sanders campaign has brought millions of young people into politics, ignited their energy and enthusiasm and idealism.

Fifth, the movement Bernie ignited has pushed Hillary Clinton to take more progressive positions on issues ranging from the minimum wage to the Trans Pacific Partnership, the XL Pipeline, Wall Street, and Social Security.

Sixth, he’s taught Americans how undemocratic the Democratic Party’s system for picking candidates really is. Before Bernie’s candidacy, not many people were paying attention to so-called “super-delegates” or whether independents could vote, or how primary elections and caucuses were run. From now on, people will pay attention. And the Democratic National Committee will be under pressure to make fundamental changes.

Seventh is the real possibility Bernie has inspired of a third party – if the Democratic Party doesn’t respond to the necessity of getting big money out of politics and reversing widening inequality, if it doesn’t begin to advocate for a single-payer healthcare system, or push hard for higher taxes on the wealthy - including a wealth tax - to pay for better education and better opportunities for everyone else, if it doesn’t expand Social Security and lift the cap on income subject to the Social Security payroll tax, if it doesn’t bust up the biggest banks and strengthen antitrust laws, and expand voting rights.

If it doesn’t act on these critical issues. the Democratic Party will become irrelevant to the future of America, and a third party will emerge to address them.

Bernie, we thank you for your courage, your inspiration, your tireless dedication, and your vision. And we will continue the fight.

The Five Principles of Patriotism

We talk a lot about Patriotism, especially around July 4th, but we need also to take to heart its five basic principles.

First: True patriotism isn’t simply about waving the American flag. And it’s not mostly about securing our borders, putting up walls and keeping others out.

It’s about coming together for the common good.

Second: Real patriotism is not cheap. It requires taking on a fair share of the burdens of keeping America going – being willing to pay taxes in full rather than seeking tax loopholes and squirreling away money abroad. Not just voting but becoming politically active, volunteering time and energy to improving this country.

Third: Patriotism is about preserving, fortifying, and protecting our democracy, not inundating it with big money and buying off politicians. It means defending the right to vote and ensuring more Americans are heard, not fewer.

Fourth: True patriots don’t hate the government of the United States. They’re proud of their country and know the government is a tool to help us solve problems together. They may not like everything it does, and they justifiably worry when special interests gain too much power over it. But true patriots work to improve our government, not destroy it.

Finally, patriots don’t pander to divisiveness. They don’t fuel racist or religious or ethnic divisions. They aren’t homophobic or sexist or racist.

To the contrary, true patriots seek to confirm and strengthen and celebrate the “we” in “we the people of the United States.”

Have a happy and safe Fourth of July.

8 REASONS WHY REPUBLICANS MUST DUMP TRUMP

The Republican Party still has time to change its mind. Right now it’s supporting for President of the United States a man

1. who divides us by race and ethnicity and religion.

He says undocumented Americans “bring drugs, crime, they’re rapists.” That the Mexican government “sends bad ones over because they don’t want to pay for them.” And who says he’ll round up and deport all 11 million undocumented workers in the United States.

This is a man who equivocated on repudiating an endorsement from David Duke, former head of the Ku Klux Klan. And when asked to repudiate the vicious anti-semitism of some of his followers said “I don’t have a message to the fans.”

A man who claimed “thousands and thousands” of Muslims in New Jersey celebrated the Twin Towers collapsing, when there’s no evidence at all to support that statement. And whose response to terrorism is to prevent all Muslims from coming into the United States.

A man who, in response to the worst mass shooting in U.S. history, did not mourn the victims, but instead crowed “Appreciate the congrats for being right on radical Islamic terrorism, I don’t want congrats, I want toughness & vigilance. We must be smart!” and repeated his call for his temporary Muslim ban – even though the shooter was an American citizen. “What has happened in Orlando is just the beginning. Our leadership is weak and ineffective. I called it and asked for the ban. Must be tough,” he said.

A man who says black criminals are responsible for 81 percent of homicides against whites, which turns out to be a racist myth.

2. whose incendiary lies are inciting violence across this land, but he excuses them.

When he learned that some of his supporters punched, kicked and spit on protesters of color at his rallies, he said “people who are following me are very passionate.”

When a handful of white supporters punched and attempted to choke a Black Lives Matter protester at another of his rallies, he said “maybe he should have been roughed up.”

3. who bullies, humiliates, and threatens those who dare cross him.

He mocks their physical characteristics, makes up lies about them, degrades them, tries to intimidate them by unleashing hostile attacks on the Internet – announcing, for example, that a family who donated money to a political opponent “better be careful, they have a lot to hide.”

He calls a federal judge who’s considering a case against Trump University a “total disgrace” and a “hater,” and alleging he’s Mexican although he was born in the United States.

4. who spreads baseless conspiracy theories.

He conjectured that President Obama was not born in the United States, and that the government hid information about the Ebola virus and a plague would start in America if flights from Ebola infected countries weren’t cancelled. He opined that Ted Cruz’s father was with Lee Harvey Oswald during the Kennedy assasination in Dallas, and that child health vaccinations cause autism.

And he suggested that the death of Supreme Court justice Antonin Scalia might have been a part of a plot.

Such baseless conspiracy theories can do great damage, when, for example, parents don’t vaccinate their children because they fear autism.

5. whose hateful and demeaning attitudes toward women and boastful claims of sexual dominance have been filling the airwaves for years.

They’re best summed up in an interview where he said “women, you have to treat them like shit.”

6. who believes climate change is not caused by humans, contrary to all scientific proof.

And he calls for more fossil fuel drilling and fewer environmental regulations, vows to cancel the Paris agreement committing nearly every nation to curbing climate change, and to rescind Obama’s rules to curb planet-warming emissions from coal-fired power plants.

7. who proposes using torture against terrorists, and punishing their families, both in clear violation of international law.

And if all this weren’t enough,

8. who wants to cut taxes on the rich, giving the wealthiest one tenth of one percent an average tax cut of more than $1.3 million each every year - exploding the national debt and endangering the future of Social Security and Medicare.

This man is Donald Trump, and the Republican Party wants him to be President of the United States.

Why are there so few statesmen left in the Republican Party? Are there no principled Republicans whose loyalty to the nation is greater than their eagerness to win back the White House? No Republican leaders with the courage to stand up and say this is wrong – that this man doesn’t have the character or the temperament to be president, and his election would endanger America and everything we believe in and stand for?

If not, shame on them.

Republicans still have time to dump Trump. For the good of the country and the world, they must.

It’s Not Over Until It’s Over

This morning I heard from an old friend here in California who said “I’m for Bernie, but he doesn’t really have a chance anymore. So isn’t my vote for him in the California primary just prolonging the agony, and indirectly helping Trump?”

I told him:

1. True, the electoral numbers are daunting, and Bernie faces an uphill task, but a win Tuesday will help enormously. One out of 8 Americans lives in California.

2. Regardless of the electoral math, Bernie’s candidacy has never been mainly about Bernie. It’s been about a movement to reclaim our democracy and economy from the moneyed interests. And a win for Bernie in the California primary (and in other Tuesday primaries in Montana, New Jersey, North Dakota South Dakota, and New Mexico) will send an even clearer signal to Washington, the Democratic Party, and the establishment as a whole, that a large and growing share of Americans is determined to wrest back control.

3. The goals Bernie has enunciated in his campaign are essential to our future: getting big money out of politics and reversing widening inequality; moving toward a single-payer healthcare system and free tuition at public universities (both financed by higher taxes on the richest Americans and on Wall Street); a $15 minimum wage; decriminalization of marijuana and an end to mass incarceration; a new voting rights act; immigration reform; and a carbon tax. All will require continued mobilization at all levels of government. A win Tuesday will help continue and build on that mobilization.

4. Bernie’s successes don’t help Trump. To the contrary, they are bringing into politics millions of young voters whose values are opposite to those of Trump’s. Bernie has received majorities from voters under age 45 (as well as from independents). He’s won even larger majorities of young people under 30 – including young women and Latinos. Many have been inspired and motivated by Bernie to become political activists – the last thing Trump and the Republicans want.

INTO THE WORLD OF WORK

What do you need to know – about the new world of work, but also about yourself – as you graduate and launch yourself into the world of work? We made a short film of my last class of the semester, where I speak to graduating seniors about these questions and more. If you’re a graduating senior (or know one) we hope this is helpful.

WHY IS THE RACIAL WEALTH GAP WIDENING? AND WHAT SHOULD BE DONE TO REVERSE IT?

Wealth inequality is even more of a problem than income inequality. That’s because you have to have enough savings from income to begin to accumulate wealth – buying a house or investing in stocks and bonds, or saving up to send a child to college.

But many Americans have almost no savings, so they have barely any wealth. Two-thirds live paycheck to paycheck.

Once you have wealth, it generates its own income as the value of that wealth increases over time, generating dividends and interest, and then even more when those assets are sold.

This is why wealth inequality is compounding faster than income inequality. The richest top 1% own 40% of the nation’s wealth. The bottom 80% own just 7%.

Wealth is also transferred from generation to generation, not only in direct transfers, but also in access to the best schools and universities. Young people who get college degrees are overwhelmingly from wealthier families.

Which is why kids from low-income families, without such wealth, start out at a huge disadvantage. This is especially true for children of color from low-income families. Such families typically rent rather than own a house, and don’t earn enough to have any savings.

Throughout much of America’s history, the federal government has given families tax breaks in order to help them save and build assets – such as paying no tax on income that’s put away for retirement, and being able to deduct interest on home mortgages.

But these tax breaks mainly help those with high income and lots of wealth in the first place, who can afford to put away lots for retirement or get a large mortgage on a huge home. They don’t much help those with low incomes and minimal savings.

Families of color are especially disadvantaged because they’re less likely to have savings or inherit wealth, and face significant barriers to building wealth, such as discriminatory policies and practices that thwart home ownership.

These structural disadvantages have built up to the point where the median net worth of white families is now more than 10 times greater than that of African-American or Latino families.

So what can we do to help all Americans accumulate wealth?

First, reform the tax system so capital gains – increases in the value of assets – are taxed at the same rate as ordinary income.

Second, limit how much mortgage interest the wealthy can deduct from their incomes.

Then use the tax savings from these changes to help lower-income people gain a foothold in building their own wealth.

For example:

1. Provide every newborn child with a savings account consisting of at least $1,250 — and more if a child is from a low-income family. This sum will compound over the years into a solid nest egg.

Research shows it could reduce the racial wealth gap by nearly 20% — more if deposits are larger. At age 18, that young person could use the money for tuition or training, a business or a home. Studies show such accounts can change children’s behavior and increase the likelihood they’ll attend college.

1. Allow families receiving public benefits to save. Today a family receiving public assistance can be cut off for having saved just $1,000. Raise the limits on what a family can save to at least $12,000—roughly three months’ income for a low-income family of four—and thereby put that family on the road to self-sufficiency.

All these steps would allow families to invest in their own futures – which is the surest way out of poverty. All of us benefit when everyone has the opportunity to accumulate wealth.

THE NEW COMMON GROUND BETWEEN POPULIST LEFT AND RIGHT

The old debate goes something like this:

‘You don’t believe women have reproductive rights.”

“You don’t value human life.”

Or this:

“You think everyone should own a gun.”

“You think we’re safer if only criminals have them.”

Or this:

“You don’t care about poor people.”

”You think they’re better off with handouts.”

Or this:

“You want to cut taxes on the rich.”

"You want to tax everyone to death.”

But we’re seeing the emergence of a new debate where the populist left and right are on the same side:

Both are against the rich to spend as much as they want corrupting our democracy.

Both are against crony capitalism.

Both are against corporate welfare.

Both are against another Wall Street bailout.

Both want to stop subsidizing Big Agriculture, Big Oil, and the pharmaceutical industry.

Both want to close the tax loophole for hedge fund partners.

Both want to ban inside trading on Wall Street.

Both want to stop CEOs from pumping up share prices with stock buy-backs … and then cashing in their stock options.

Both want to stop tax deductions of CEO pay over $1 million.

Both want to get big money out of politics, reverse Citizens United, and restore our democracy,

If we join together, we can make these things happen.

Stop Voter Suppression

A crowning achievement of the historic March on Washington, where Dr. Martin Luther King gave his “I have a dream” speech, was pushing through the landmark Voting Rights Act of 1965. Recognizing the history of racist attempts to prevent Black people from voting, that federal law forced a number of southern states and districts to adhere to federal guidelines allowing citizens access to the polls.

But in 2013 the Supreme Court effectively gutted many of these protections. As a result, states are finding new ways to stop more and more people—especially African-Americans and other likely Democratic voters—from reaching the polls.

Several states are requiring government-issued photo IDs—like drivers licenses—to vote even though there’s no evidence of the voter fraud this is supposed to prevent. But there’s plenty of evidence that these ID measures depress voting, especially among communities of color, young voters, and lower-income Americans.

Alabama, after requiring photo IDs, has practically closed driver’s license offices in counties with large percentages of black voters. Wisconsin requires a government-issued photo ID but hasn’t provided any funding to explain to prospective voters how to secure those IDs.

Other states are reducing opportunities for early voting.

And several state legislatures—not just in the South—are gerrymandering districts to reduce the political power of people of color and Democrats, and thereby guarantee Republican control in Congress.

We need to move to the next stage of voting rights—a new Voting Rights Act—that renews the law that was effectively repealed by the conservative activists on the Supreme Court.

That new Voting Rights Act should also set minimum national standards—providing automatic voter registration when people get driver’s licenses, allowing at least 2 weeks of early voting, and taking districting away from the politicians and putting it under independent commissions.

Voting isn’t a privilege. It’s a right. And that right is too important to be left to partisan politics. We must not allow anyone’s votes to be taken away.

Why Either Trump’s and Cruz’s Tax Plans Would Be the Largest Redistributions to the Rich in American History

The tax cuts for the rich proposed by the two leading Republican candidates for the presidency – Donald Trump and Ted Cruz – are larger, as a proportion of the government budget and the total economy, than any tax cuts ever before proposed in history.

Trump and Cruz pretend to be opposed to the Republican establishment, but when it comes to taxes they’re seeking exactly what that Republican establishment wants.

Here are 5 things you need to know about their tax plans:

1. Trump’s proposed cut would reduce the top tax rate from 39.6 percent to 25 percent – creating a giant windfall for the wealthy (at a time when the wealthy have a larger portion of the nation’s wealth than any time since 1918). According to the Center for Tax Policy, the richest one tenth of one percent of taxpayers (those with incomes over $3.7 million) would get an average tax cut of more than $1.3 million each every year. Middle-income households would get an average tax cut of $2,700.

2. The Cruz plan would abandon our century-old progressive income tax (whose rates increase as taxpayers’ incomes increase) and instead tax the amount people spend in a year and exclude income from investments. This sort of system would burden lower-income workers who spend almost everything they earn and have few if any investments.

3. Cruz also proposes a 10 percent flat tax. A flat tax lowers tax rates on the rich and increases taxes for lower-income workers.

4. The Republican plans also repeal estate and gift taxes – now paid almost entirely by the very wealthy who make big gifts to their heirs and leave them big estates.

5. These plans would cut federal revenues by as much as $12 trillion over the decade – but neither Trump nor Cruz has said what they’ll do to fill this hole. They both want to increase the military. Which leaves them only two choices: Either explode the national debt, or cut Social Security, Medicare, and assistance to the poor.

Bottom line: If either of these men is elected president, we could see the largest redistribution in American history from the poor and middle-class of America to the rich. This is class warfare with a vengeance.

10 Reasons Marco Rubio is no Moderate

Marco Rubio is being positioned as a moderate alternative to Ted Cruz or Donald Trump. Baloney. His positions are extreme right. Consider these 10 facts about Rubio:

1. Rubio wants to repeal Obama’s executive order to expand background checks and close gun sale loopholes.

2. When asked about closing down mosques, Rubio said he wants to shutdown “any place radicals are inspired.”

3. He denies humans are responsible for climate change.

4. His tax plan gives the top 1 percent over $200,000 in tax cuts every year. That’s as bad as Donald Trump’s tax plan.

5. He wants to cut $4.3 trillion in spending, including funds from Medicare and other programs, essentially freeze federal spending at 2008 levels for everything except the Pentagon.

6. He wants a permanent U.S. presence in Iraq, and would end the nuclear deal with Iran, putting us on a path to war.

7. We have no way to know where he is on immigration because he’s flip-flopped — first working on legislation to regularize citizenship for undocumented immigrants, and now firmly anti-legalization.

8. He wants to repeal Obamacare.

9. He’s against a woman’s right to choose, even in cases of rape and incest.

10. Although elected to the Senate as a Tea Party favorite, he’s now the establishment’s favorite Republican. Among his donors are hedge-fund billionaire Paul Singer and the executives and PACs of Goldman Sachs, Wells Fargo, and Koch Industries.

4 Reasons Ted Cruz is Even More Dangerous than Donald Trump.

1. Cruz is more fanatical. Sure, Trump is a bully and bigot, but he doesn’t hew to any sharp ideological line. Cruz is a fierce ideologue: He denies the existence of man-made climate change, rejects same-sex marriage, wants to abolish the Internal Revenue Service, believes the 2nd amendment guarantees everyone a right to guns. He doesn’t believe in a constitutional divide between church and state, favors the death penalty, rejects immigration reform, demands the repeal of Obamacare, and takes a strict “originalist” view of the meaning of the Constitution.

2. Cruz is a true believer. Trump has no firm principles except making money, getting attention, and gaining power. But Cruz has spent much of his life embracing radical right economic and political views.

3. Cruz is more disciplined and strategic. Trump is all over the place, often winging it, saying whatever pops into his mind. Cruz hews to a clear script and a carefully crafted strategy. He plays the long game (as he’s shown in Iowa).

4. Cruz is a loner who’s willing to destroy government institutions to get his way. Trump has spent his career using the federal government and making friends with big shots. Not Cruz. He has repeatedly led Republicans toward fiscal cliffs. In the Fall of 2013, his opposition to Obamacare led in a significant way to the shutdown of the federal government.

Both men would be disasters for America, but Ted Cruz would be the larger disaster.

Six Responses to Bernie Skeptics:

1. “He’d never beat Trump or Cruz in a general election.”

Wrong. According to the latest polls, Bernie is the strongest Democratic candidate in the general election, defeating both Donald Trump and Ted Cruz in hypothetical matchups. (The latest RealClear Politics averages of all polls shows Bernie beating Trump by a larger margin than Hillary beats Trump, and Bernie beating Cruz while Hillary loses to Cruz.)

2. “He couldn’t get any of his ideas implemented because Congress would reject them.”

If both house of Congress remain in Republican hands, no Democrat will be able to get much legislation through Congress, and will have to rely instead on executive orders and regulations. But there’s a higher likelihood of kicking Republicans out if Bernie’s “political revolution” continues to surge around America, bringing with it millions of young people and other voters, and keeping them politically engaged.

3. “America would never elect a socialist.”

P-l-e-a-s-e. America’s most successful and beloved government programs are social insurance – Social Security and Medicare. A highway is a shared social expenditure, as is the military and public parks and schools. The problem is we now have excessive socialism for the rich (bailouts of Wall Street, subsidies for Big Ag and Big Pharma, monopolization by cable companies and giant health insurers, giant tax-deductible CEO pay packages) – all of which Bernie wants to end or prevent.

4. “His single-payer healthcare proposal would cost so much it would require raising taxes on the middle class.”

This is a duplicitous argument. Single-payer systems in other rich nations have proven cheaper than private for-profit health insurers because they don’t spend huge sums on advertising, marketing, executive pay, and billing. So even if the Sanders single-payer plan did require some higher taxes, Americans would come out way ahead because they’d save far more than that on health insurance.

5. “His plan for paying for college with a tax on Wall Street trades would mean colleges would run by government rules.”

Baloney. Three-quarters of college students today already attend public universities financed largely by state governments, and they’re not run by government rules. The real problem is too many young people still can’t afford a college education. The move toward free public higher education that began in the 1950s with the G.I. Bill and extended into the 1960s came to an abrupt stop in the 1980s. We must restart it.

6. “He’s too old.”

Untrue. He’s in great health. Have you seen how agile and forceful he is as he campaigns around the country? These days, 70s are the new 60s. (He’s younger than four of the nine Supreme Court justices.) In any event, the issue isn’t age; it’s having the right values. FDR was paralyzed.” In any event, the issue isn’t age; it’s having the right values. was paralyzed, and JFK had Addison’s Crohn’s diseases, but they were great presidents because they fought adamantly for social and economic justice.

HOW TO DEAL WITH YOUR UNCLE BOB

In preparation for the holidays, here’s a survival guide for dealing with your right-wing relatives.

LOOK WHO’S BUYING AMERICAN DEMOCRACY

According to an investigation by the New York Times, half of all the money contributed so far to Democratic and Republican presidential candidates—$176 million—has come from just 158 families, along with the companies they own or control.

Who are these people? They’re almost entirely white, rich, older and male—even though America is becoming increasingly black and brown, young, female, and with declining household incomes.

According to the report, most of these big contributors live in exclusive neighborhoods where they have private security guards instead of public police officers, private health facilities rather than public parks and pools.

Most send their kids and grand kids to elite private schools rather than public schools. They fly in private jets and get driven in private limousines rather than rely on public transportation.

They don’t have to worry about whether Social Security or Medicare will be there for them in their retirement because they’ve put away huge fortunes. They don’t have to worry about climate change because they don’t live in flimsy homes that might collapse in a hurricane, or where water is scarce, or food supplies endangered.

It’s doubtful that most of these 158 are contributing to these campaigns out of the goodness of their hearts or a sense of public responsibility. They’re largely making investments, just the way they make other investments.

And the success of these investments depends on whether their candidates get elected, and will lower their taxes even further, expand tax loopholes, shred health and safety and environmental regulations so their companies can make even more money, and cut Social Security and Medicare and programs for the poor—and thereby allow these 158 and others like them to secede even more from the rest of our society.

These people are, after all, are living in their own separate society, and they want to elect people who will represent them, not the rest of us.

How much more evidence do we need that our system is in crisis? How long before we make it work for all of us instead of a handful at the top? We must not let them buy our democracy. We must get big money out of politics. Publicly-finance political campaigns, disclose all sources of campaign funds, and reverse “Citizens United.”

PAUL RYAN’S 7 TERRIBLE IDEAS

Yesterday, the new Speaker of the House, Paul Ryan, summed up his House Republican agenda – vowing to pursue legislation that would frame a stark choice for voters in 2016.

“Our No. 1 goal for the next year is to put together a complete alternative to the left’s agenda,” he said.

Despite the speech’s sweeping oratory and careful stagecraft, Ryan clings to seven dumb ideas that are also cropping up among Republican presidential candidates.

Here they are, and here’s why they’re dumb:

1. Reduce the top income-tax rate to 25% from the current 39%. A terrible idea. It’s a huge windfall to the rich at a time when the rich already take home a larger share of total income that at any time since the 1920s.

2. Cut corporate taxes to 25% from the current 35%. Another bad idea. A giant sop to corporations, the largest of which are already socking away $2.1 trillion in foreign tax shelters.

3. Slash spending on domestic programs like food stamps and education for poor districts. What?! Already 22% of the nation’s children are in poverty; these cuts would only make things worse.

4. Turn Medicaid and other federal programs for the poor into block grants for the states, and let the states decide how to allocate them. In other words, give Republican state legislatures and governors slush funds to do with as they wish.

5. Turn Medicare into vouchers that don’t keep up with increases in healthcare costs. In effect cutting Medicare for the elderly. Another awful idea.

6. Deal with rising Social Security costs by raising the retirement age for Social Security. Bad! This would make Social Security even more regressive, since the poor don’t live nearly as long as the rich.

7. Finally, let the minimum wage continue to decline as inflation eats it away. Wrong again. Low wage workers need a higher minimum wage.

These 7 ideas will harm most Americans. Ryan is wrong.

WHY THE SHARING ECONOMY IS HARMING WORKERS – AND WHAT MUST BE DONE

In this holiday season it’s especially appropriate to acknowledge how many Americans don’t have steady work.

The so-called “share economy” includes independent contractors, temporary workers, the self-employed, part-timers, freelancers, and free agents. Most file 1099s rather than W2s, for tax purposes.

It’s estimated that in five years over 40 percent of the American labor force will be in such uncertain work; in a decade, most of us.

Already two-thirds of American workers are living paycheck to paycheck.

This trend shifts all economic risks onto workers. A downturn in demand, or sudden change in consumer needs, or a personal injury or sickness, can make it impossible to pay the bills.

It eliminates labor protections such as the minimum wage, worker safety, family and medical leave, and overtime.

And it ends employer-financed insurance – Social Security, workers’ compensation, unemployment benefits, and employer-provided health insurance under the Affordable Care Act.

No wonder, according to polls, almost a quarter of American workers worry they won’t be earning enough in the future. That’s up from 15 percent a decade ago.

Such uncertainty can be hard on families, too. Children of parents working unpredictable schedules or outside standard daytime working hours are likely to have lower cognitive skills and more behavioral problems, according to new research.

What to do?

Courts are overflowing with lawsuits over whether companies have misclassified “employees” as “independent contractors,” resulting in a profusion of criteria and definitions.

We should aim instead for simplicity: Whoever pays more than half of someone’s income, or provides more than half their working hours should be responsible for all the labor protections and insurance an employee is entitled to.

In addition, to restore some certainty to people’s lives, we need to move away from unemployment insurance and toward income insurance.

Say, for example, your monthly income dips more than 50 percent below the average monthly income you’ve received from all the jobs you’ve taken over the preceding five years. With income insurance, you’d automatically receive half the difference for up to a year.

It’s possible to have a flexible economy and also provide workers some minimal level of security.

A decent society requires no less.

THE 4 BIG LIES ABOUT IMMIGRANTS – AND THE TRUTH

Donald Trump has opened the floodgates to lies about immigration. Here are the myths, and the facts

MYTH: Immigrants take away American jobs.

Wrong. Immigrants add to economic demand, and thereby push firms to create more jobs.

MYTH: We don’t need any more immigrants.

Baloney. The U.S. population is aging. Twenty-five years ago, each retiree in America was matched by 5 workers. Now for each retiree there are only 3 workers. Without more immigration, in 15 years the ratio will fall to 2 workers for every retiree, not nearly enough to sustain our retiree population.

MYTH: Immigrants are a drain on public budgets.

Bull. Immigrants pay taxes! The Institute on Taxation and Economic Policy released a report this year showing undocumented immigrants paid $11.8 billion in state and local taxes in 2012 and their combined nationwide state and local tax contributions would increase by $2.2 billion under comprehensive immigration reform. MYTH: Legal and illegal immigration is increasing.

Wrong again. The net rate of illegal immigration into the U.S. is less than zero. The number of undocumented immigrants living in the U.S. has declined from 12.2 million in 2007 to 11.3 million now, according to Pew Research Center.

Don’t listen to the demagogues who want to blame the economic problems of the middle class and poor on new immigrants, whether here legally or illegally. The real problem is the economic game is rigged in favor of a handful at the top, who are doing the rigging.

We need to pass comprehensive immigration reform, giving those who are undocumented a path to citizenship.

Scapegoating them and other immigrants is shameful.

And it’s just plain wrong.

AUSTERITY 101: The Three Reasons Republican Deficit Hawks Are Wrong

Congress is heading into another big brawl over the federal budget deficit, the national debt, and the debt ceiling.

Republicans are already talking about holding Social Security and Medicare “hostage” during negotiations—hell-bent on getting cuts in exchange for a debt limit hike.

Days ago, U.S. Treasury Secretary Jacob Lew asked whether our nation would “muster the political will to avoid the self-inflicted wounds that come from a political stalemate.”

It’s a fair question. And there’s only one economically sound answer: Congress must raise the debt ceiling, end the sequester, put more people to work, and increase our investment in education and infrastructure.

Here are the three reasons why Republican deficit hawks are wrong. (Please watch and share our attached video.)

FIRST: Deficit and debt numbers are meaningless on their own. They have to be viewed as a percent of the national economy.

That ratio is critical. As long as the yearly deficit continues to drop as a percent of the national economy, as it’s been doing for several years now, we can more easily pay what we owe.

SECOND: America needs to run larger deficits when lots of people are unemployed or underemployed – as they still are today, when millions remain too discouraged to look for jobs and millions more are in part-time jobs and need full-time work.

As we’ve known for years – in every economic downturn and in every struggling recovery – more government spending helps create jobs – teachers, fire fighters, police officers, social workers, people to rebuild roads and bridges and parks. And the people in these jobs create far more jobs when they spend their paychecks.

This kind of spending thereby grows the economy – thereby increasing tax revenues and allowing the deficit to shrink in proportion.

Doing the opposite – cutting back spending when a lot of people are still out of work – as Congress has done with the sequester, as much of Europe has done – causes economies to slow or even shrink, which makes the deficit larger in proportion.

This is why austerity economics is a recipe for disaster, as it’s been in Greece. Creditors and institutions worried about Greece’s debt forced it to cut spending, the spending cuts led to a huge economic recession, which reduced tax revenues, and made the debt crisis there worse.

THIRD AND FINALLY: Deficit spending on investments like education and infrastructure is different than other forms of spending, because this spending builds productivity and future economic growth.

It’s like a family borrowing money to send a kid to college or start a business. If the likely return on the investment exceeds the borrowing costs, it should be done.

Keep these three principles in mind and you won’t be fooled by scare tactics of the deficit hawks.

And you’ll understand why we have to raise the debt ceiling, end the sequester, put more people to work, and increase rather than decrease spending on vital public investments like education and infrastructure.

WHY WE MUST END UPWARD PRE-DISTRIBUTIONS TO THE RICH

You often hear inequality has widened because globalization and technological change have made most people less competitive, while making the best educated more competitive.

There’s some truth to this. The tasks most people used to do can now be done more cheaply by lower-paid workers abroad or by computer-driven machines.

But this common explanation overlooks a critically important phenomenon: the increasing concentration of political power in a corporate and financial elite that has been able to influence the rules by which the economy runs.

As I argue in my new book, “Saving Capitalism: For the Many, Not the Few” (out this week), this transformation has amounted to a pre-distribution upward.

Intellectual property rights—patents, trademarks, and copyrights—have been enlarged and extended, for example, creating windfalls for pharmaceutical companies.

Americans now pay the highest pharmaceutical costs of any advanced nation.

At the same time, antitrust laws have been relaxed for corporations with significant market power, such as big food companies, cable companies facing little or no broadband competition, big airlines, and the largest Wall Street banks.

As a result, Americans pay more for broadband Internet, food, airline tickets, and banking services than the citizens of any other advanced nation.

Bankruptcy laws have been loosened for large corporations—airlines, automobile manufacturers, even casino magnates like Donald Trump—allowing them to leave workers and communities stranded.

But bankruptcy has not been extended to homeowners burdened by mortgage debt or to graduates laden with student debt. Their debts won’t be forgiven.

The largest banks and auto manufacturers were bailed out in 2008, shifting the risks of economic failure onto the backs of average working people and taxpayers.

Contract laws have been altered to require mandatory arbitration before private judges selected by big corporations. Securities laws have been relaxed to allow insider trading of confidential information.

CEOs now use stock buybacks to boost share prices when they cash in their own stock options.

Tax laws have special loopholes for the partners of hedge funds and private-equity funds, special favors for the oil and gas industry, lower marginal income-tax rates on the highest incomes, and reduced estate taxes on great wealth.

Meanwhile, so-called “free trade” agreements, such as the pending Trans Pacific Partnership, give stronger protection to intellectual property and financial assets but less protection to the labor of average working Americans.

Today, nearly one out of every three working Americans is in a part-time job. Many are consultants, freelancers, and independent contractors. Two-thirds are living paycheck to paycheck.

And employment benefits have shriveled. The portion of workers with any pension connected to their job has fallen from just over half in 1979 to under 35 percent today.

Labor unions have been eviscerated. Fifty years ago, when General Motors was the largest employer in America, the typical GM worker, backed by a strong union, earned $35 an hour in today’s dollars.

Now America’s largest employer is Walmart, and the typical entry-level Walmart worker, without a union, earns about $9 an hour.

More states have adopted so-called “right-to-work” laws, designed to bust unions. The National Labor Relations Board, understaffed and overburdened, has barely enforced collective bargaining.

All of these changes have resulted in higher corporate profits, higher returns for shareholders, and higher pay for top corporate executives and Wall Street bankers – and lower pay and higher prices for most other Americans.

They amount to a giant pre-distribution upward to the rich. But we’re not aware of them because they’re hidden inside the market.

The underlying problem, then, is not just globalization and technological changes that have made most American workers less competitive. Nor is it that they lack enough education to be sufficiently productive.

The more basic problem is that the market itself has become tilted ever more in the direction of moneyed interests that have exerted disproportionate influence over it, while average workers have steadily lost bargaining power—both economic and political—to receive as large a portion of the economy’s gains as they commanded in the first three decades after World War II.

Reversing the scourge of widening inequality requires reversing the upward pre-distributions within the rules of the market, and giving average people the bargaining power they need to get a larger share of the gains from growth.

The answer to this problem is not found in economics. It is found in politics. Ultimately, the trend toward widening inequality in America, as elsewhere, can be reversed only if the vast majority join together to demand fundamental change.

The most important political competition over the next decades will not be between the right and left, or between Republicans and Democrats. It will be between a majority of Americans who have been losing ground, and an economic elite that refuses to recognize or respond to its growing distress.

Why We Must Fight the Attack on Planned Parenthood

On Thursday, right-wing extremists in the U.S. House of Representatives will vote to try to defund Planned Parenthood, one of the nation’s largest providers of women’s health care and family planning services.

Planned Parenthood is under attack and it’s up to all of us to fight back. Any society that respects women must respect their right to control their own bodies. There is a strong moral case to be made for this — but this video isn’t about that. This is about the economics of family planning – which are one more reason it’s important for all of us to stand up and defend Planned Parenthood.

Reproductive rights, family planning, and women’s health are all interrelated. All girls and women need full information and access to family planning services, including abortion—regardless of their income level—so they can determine if or when they have children.

Public investments in family planning—enabling women to plan, delay, or avoid pregnancy– make economic sense, because reproductive rights are also productive rights. When women have control over their lives, they can contribute even more to the economy, better break the glass ceiling, equalize the pay gap, and much more.

Take the state of Colorado’s highly successful family planning program. Over the past six years, in Colorado health department has offered teenagers and low-income women free long-acting birth control that prevents pregnancy over several years. Pregnancy and abortion rates plunged—by about 40 percent among teenagers across the state from 2009 to 2013.

In 2009, half of all first births to women in the poorest areas of the state occurred before they turned 21. But by 2014, half of first births did not occur until the women had turned 24, a difference that gives young women time to finish their education and obtain better jobs.

Nationally, evidence shows that public investments in family planning result in net public savings of about $13.6 billion a year—over $7 for every public dollar spent.

This sum doesn’t include the billions of additional dollars saved by enabling women who may not be financially able to raise a child and do not want to have a child or additional children to stay out of poverty.

Yet, over the last five years Republicans have cut 10 percent of the Title X federal budget for family planning, which also pays for critical services such as cancer screenings and HIV tests. And the Republican-controlled House Appropriations Committee has gone as far as trying to eliminate the program.

Meanwhile, many states have been cutting or eliminating family-planning funds. This isn’t just morally wrong; its bad economics.

Obviously, these crass economic numbers don’t nearly express the full complexity of the national debate around abortion and family planning. But they help make the case that we all benefit when society respects women to control their bodies and plan their families.

Please watch my latest video, which includes the economic argument for funding family planning and women’s health services, and why it’s critical that all of us step up right now to defend Planned Parenthood.

CORPORATE WELFARE IN CALIFORNIA

Corporate welfare is often camouflaged in taxes that seem neutral on their face but give windfalls to big entrenched corporations at the expense of average people and small businesses.

Take a look at commercial property taxes in California, for example.

In 1978 California voters passed Proposition 13 – which began to assess property for tax purposes at its price when it was bought, rather than its current market price.

This has protected homeowners and renters. But it’s also given a quiet windfall to entrenched corporate owners of commercial property.

Corporations don’t need this protection. They’re in the real economy. They’re supposed to compete on a level playing field with new companies whose property taxes are based on current market prices.

This corporate windfall has caused three big problems.

First, it’s shifted more of the property tax on to California homeowners.

Back in 1978, corporations paid 44 percent of all property taxes and homeowners paid 56 percent. Now, after exploiting this loophole for years, corporations pay only 28 percent of property taxes, while homeowners pick up 72 percent of the tab.

Second, it’s robbed California of billions of dollars to support schools and local services. If all corporations were paying the property taxes they should be paying, schools and local services would have $9 billion dollars more in revenues this year.

Third, it penalizes new and expanding businesses that don’t get this windfall because their commercial property is assessed at the current market price – but they compete for customers with companies whose property is assessed at the price they purchased it years ago.

That’s unfair and it’s bad for the economy because California needs new and expanding businesses.

Today, almost half of all commercial properties in California pay their fair share of property taxes, but they’re hobbled by those that don’t.

This loophole must be closed. All corporations should be paying commercial property taxes based on current market prices.

The giant corporations that are currently exploiting the loophole for their own profits obviously don’t want it closed, so they’re trying to scare people by saying closing it will cause businesses to leave California.

That’s baloney. Leveling the playing field for all businesses will make the California economy more efficient, and help new and expanding businesses.

Besides, California’s property taxes are already much lower than the national average. So even if corporations pay their full share, they’re still getting a great deal.

Right now, a grassroots movement is growing of Californians determined to reform this broken commercial property tax system, and who know California needs more stable funding for its schools, libraries, roads, and communities.

WHAT THE FED’S ABOUT TO DO WILL AFFECT YOUR JOB AND YOUR INCOME, AND HERE’S WHAT YOU CAN DO TO MAKE SURE THE FED MAKES THE RIGHT DECISION

ON PATRIOTISM

A few words about patriotism – something we talk a lot about, especially around July 4th, but seldom stop to examine its real meaning.

True patriotism isn’t simply about waving the American flag. And it’s not mostly about securing our borders from outsiders.

It’s about coming together for the common good.

Real patriotism is not cheap. It requires taking on a fair share of the burdens of keeping America going – being willing to pay taxes in full rather than seeking tax loopholes and squirreling away money abroad.

Patriotism is about preserving and protecting our democracy, not inundating it with big money and buying off politicians.

True patriots don’t hate the government of the United States. They’re proud of it. They may not like everything it does, and they justifiably worry when special interests gain too much power over it. But true patriots work to improve our government, not destroy it.

Finally, patriots don’t pander to divisiveness. They don’t fuel racist or religious or ethnic divisions. They aren’t homophobic or sexist.

To the contrary, true patriots seek to confirm and strengthen the “we” in “we the people of the United States.”

Have a happy and safe Fourth of July.

OVERTIME: FINALLY, A BREAK FOR THE MIDDLE CLASS

The U.S. Department of Labor just proposed raising the overtime threshold – what you can be paid and still qualify to be paid “time-and-a-half” beyond 40 hours per week – from $23,600 a year to $50,400.

This is a big deal. Some 5 million workers will get a raise. (See accompanying video, which we made last month.)

Business lobbies are already hollering this will kill jobs. That’s what they always predict – whether it’s raising the minimum wage, Obamacare, family and medical leave, or better worker safety. Yet their predictions never turn out to be true.

In fact, the new rule is likely to increase the number of jobs. That’s because employers who don’t want to pay overtime have an obvious option: They can hire more workers and employ each of them for no more than 40 hours a week.

It’s high time for this change. When the overtime threshold was at its peak a half-century ago, more than 60 percent of salaried workers qualified for overtime pay. But inflation has eroded that old threshold. Today, only about 8 percent of salaried workers qualify.

Overtime pay has become such a rarity that many Americans don’t even realize that the majority of salaried workers were once eligible for it.

We just keep working longer and harder, for less. A recent Gallup poll found that salaried Americans now report working an average of 47 hours a week—not the supposedly standard 40—while 18 percent of Americans report working more than 60 hours a week.

Meanwhile, corporate profits have doubled over the last three decades – from about 6% of GDP to about 12% – while wages have fallen by almost exactly the same amount.

The erosion of overtime and other labor protections is one of the main factors worsening inequality. A higher overtime threshold will help reverse this trend.

Finally, a bit of good news for hard-working Americans.

[This post is drawn from a piece co-authored with Nick Hanauer with the help of the Center for American Progress.]

#12. MOST IMPORTANT OF ALL: GET BIG MONEY OUT OF POLITICS

Over the past two months, the videos I’ve done with MoveOn.org have detailed several ways to make the economy work for the many, not the few: raising the minimum wage to $15 an hour, making public higher education free, busting up the big banks, expanding Social Security, making polluters pay, raising the estate tax, strengthening unions, ending corporate welfare, helping families succeed economically, and letting all Americans buy into Medicare.

But none of these is possible if we don’t get big money out of politics.

In fact, nothing we need to do as a nation is possible unless we limit the political power of the moneyed interests.

So we made one more video – the one accompanying this post – and it’s incredibly important you share this one, too.

At the rate we’re going, the 2016 election is likely to be the most expensive in history – and the moneyed interests will be responsible for most of it. Our democracy is broken, and we must fix it.

Easy to say, but how do we do it?

First and most immediately, require full disclosure of all original sources of campaign money – so the public knows who’s giving what to whom, and can hold politicians accountable if they do favors for contributors while neglecting their responsibilities to all of us.